Page 64 - hisdeSAT annual report 2011

P. 64

OUR FIGURES

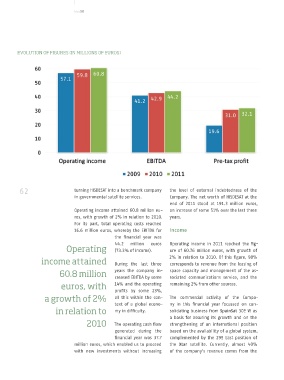

EvoluTIon of fIGurES (In mIllIonS of EuroS)

international market, with clients such as

the American State Department, the Belgian

and Norwegian Ministries of Defence and

the Danish Navy; the portfolio of national

clients was also extended to other Minis-

tries as well as that of Defence, such as the

Home Office and Foreign Affairs.

The majority of the company’s income

comes from long term contracts, which au-

gurs stability of growth in future years, with

said growth limited by the total available which 16.60 million correspond to operat-

satellite capacity, until new projects are ing costs, and 15.64 correspond to fixed as-

commercialized. set amortizations.

During the 2011 financial year HISDESAT pro- The largest entries under the heading of op-

vided its secure communications services to erating costs correspond to the sub-con-

its principal clients without interruption. tracting to third parties of satellite capacity

and in-orbit life insurance. Within the re-

EBITDA /EBIT mainder of the general costs, HISDESAT saw

62 turning HISDESAT into a benchmark company the level of external indebtedness of the 63 an increase associated with the incorpora-

in governmental satellite services. Company. The net worth of HISDESAT at the During the financial year, HISDESAT incurred tion of new material and human resourc-

end of 2011 stood at 191.3 million euros, operating costs of 32.55 million euros, of es for the observation Project and the new

Operating income attained 60.8 million eu- an increase of some 51% over the last three HisNorSat satellite, while in the communi-

ros, with growth of 2% in relation to 2010. years. cations activity the usual cost containment

For its part, total operating costs reached policy was upheld. During the period of

16.6 million euros, whereby the EBITDA for Income growth, staffing levels at the company in-

mAIn fIGurES (In mIllIonS of EuroS)

the financial year was creased by some 19%.

million

44.2

operating (73.3% of income). euros Operating income in 2011 reached the fig- The amortizations entry corresponds to the

ure of 60.76 million euros, with growth of

income attained During the last three 2% in relation to 2010. Of this figure, 98% provision for amortization of the SpainSat

corresponds to revenue from the leasing of

60.8 million years the company in- space capacity and management of the as-

creased EBITDA by some

sociated communications service, and the

euros, with 14% and the operating remaining 2% from other sources.

profits by some 23%,

a growth of 2% all this within the con- The commercial activity of the Compa-

text of a global econo- ny in this financial year focussed on con-

in relation to my in difficulty. solidating business from SpainSat 30º W as

a basis for assuring its growth and on the

2010 The operating cash flow strengthening of an international position

generated during the based on the availability of a global system,

financial year was 37.7 complemented by the 29º East position of

million euros, which enabled us to proceed the Xtar satellite. Currently, almost 40%

with new investments without increasing of the company’s revenue comes from the