Page 59 - hisdeSAT annual report 2012

P. 59

HISDESAT IN FIGURES

6.1 Financial results The solidity of the business

model, generating recurrent income based on the provision of

services of a governmental and strategic nature, has enabled

Hisdesat to increase its activities, achieving a new top line

with income of 62,5 million euros in 2012, despite the tough

environment in which the company pursues its business.

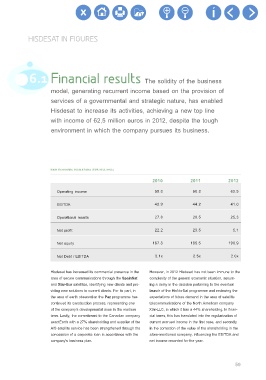

MAIN ECONOMIC INDICATORS (EUR MIllIONS)

2010 2011 2012

Operating income 59.8 60.8 62.5

EBITDA 42.9 44.2 41.0

Operational results 27.8 28.5 25.3

Net profit 22.2 23.5 5.1

Net equity 167.8 185.5 190.9

Net Debt / EBITDA 3.1x 2.5x 2.0x

Hisdesat has increased its commercial presence in the However, in 2012 Hisdesat has not been immune to the

area of secure communications through the SpainSat complexity of the general economic situation, assum-

and Xtar-Eur satellites, identifying new clients and pro- ing a delay in the decision pertaining to the eventual

viding new solutions to current clients. For its part, in launch of the HisNorSat programme and reviewing the

the area of earth observation the Paz programme has expectations of future demand in the area of satellite

continued its construction process, representing one telecommunications of the North American company

of the company’s developmental axes in the medium Xtar-LLC, in which it has a 44% shareholding. In finan-

term. Lastly, the commitment to the Canadian company cial terms, this has translated into the regularization of

exactEarth with a 27% shareholding and supplier of the current accrued income in the first case, and secondly

AIS satellite service has been strengthened through the in the correction of the value of the shareholding in the

concession of a corporate loan in accordance with the afore-mentioned company, influencing the EBITDA and

company’s business plan. net income recorded for the year.

59